With last week’s proclamation from popular economist Harry Dent and his stark warning about the U.S. economy in 2024, anyone with a pulse could not wonder if he could be right. Anyone with a pulse knows that something about this economy isn’t right. Current small business lending levels from community banks are now nothing short of catastrophic. And, with the nature of day to day living conditions for most Americans living pay check to pay check and still wrestling with the results of two year’s crippling inflation, you simply cannot help but understand concerns about the possibilities of Dent’s correctness of his prediction. If he’s right and the future financial landscape is one headed down a possible perilous path, what’s in store for us?

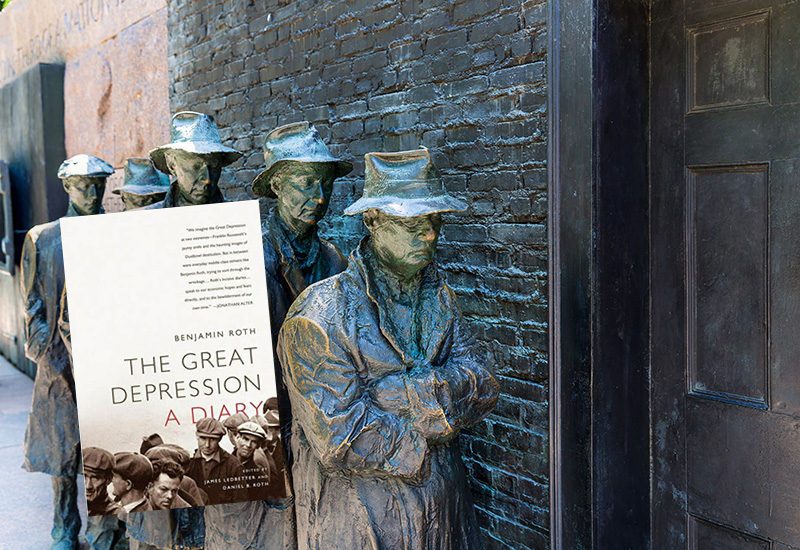

Of course, too few living today can relate to living through the economic depression of the 30s. I certainly cannot…though I do remember hearing stories about it and I am certain I would not have fared well if I had. A few years back, however, I picked up a book that provides a stark and riveting account of exactly what it was like to scratched and clawed through the ten years between the beginnings of the Great Depression and the beginning of the Second World War. And if you found Dent’s proclamation a bit unnerving and without question, I can recommend this book highly.

A Daily Log of the Great Depression

When the stock market crashed in 1929, author Benjamin Roth was a young lawyer and middle-class American in Youngstown, Ohio. The Great Depression: A Diary is just that…a diary. As Roth began to understand the significance and consequences of what was occurring to everyday Americans and their way of life, he decided to record his impressions of the event.

For readers and economics buffs, this book is nothing short of a daily log of the Great Depression. It is a almanac of entries and reveals the effects of the Great Depression by one who was living through this. Roth’s first hand accounts of events as they unfolded sets this book apart from those typical texts presenting the depression from only an economic event. What really sets this book apart is the author’s first hand account of experiences as they unfolded as compared to more common historical accountings of the period. Roth’s entries evidence his predictions and anticipated results of daily news stories from various cities and then, as if to keep your attention, would actually go back and review past entries and add updates such as “These predictions turned out to be completely wrong.”.

Savings Passbooks Quoted as Stocks

One of the experiences you will take with you from reading this treasure is that during the depression, there simply was no money! Roth repeated throughout the book was that no one ha physical cash. The combination of the 1929 stock market crash and continued market decline of (90% in all) along with the widespread bank failures meant that there were no savings. Even the banks that didn’t fail basically froze their customer’s savings accounts and set draconian limits regarding how much money a customer could withdraw in a day. In some cases, it was as low as just a few percent of the money in their account.

In many cases, people became so desperate for cash they sold their savings passbooks (those on shuttered banks) for just a few cents on the dollar. In fact, prices on passbooks on banks were actually quoted daily in the newspaper just like stocks. Those with cash purchased passbooks and then made backdoor deals with the banks, trading purchased passbooks in return for foreclosed real estate. This was not only common, but in many cases it allowed the banks to actually reopen since they no longer had the obligation on the passbook savings.

An Exceptional Read That Many Small Business Owners Will Enjoy and Learn From

In today’s more than challenging economy, the development of a keen knowledge of small business finance products is essential for entrtepreneurs. You need to have an awareness of upcoming economic trends and how they can affect your small company. Recessions can not only have a disastrous effect on most small businesses when it comes to cash flow, it can also spell their demise.

Factoring, and many other alternative commercial finance products, have stood the test of time when many small business banks did not. At IACFB, we recognize the periodic need for such financing options when the banks say NO!